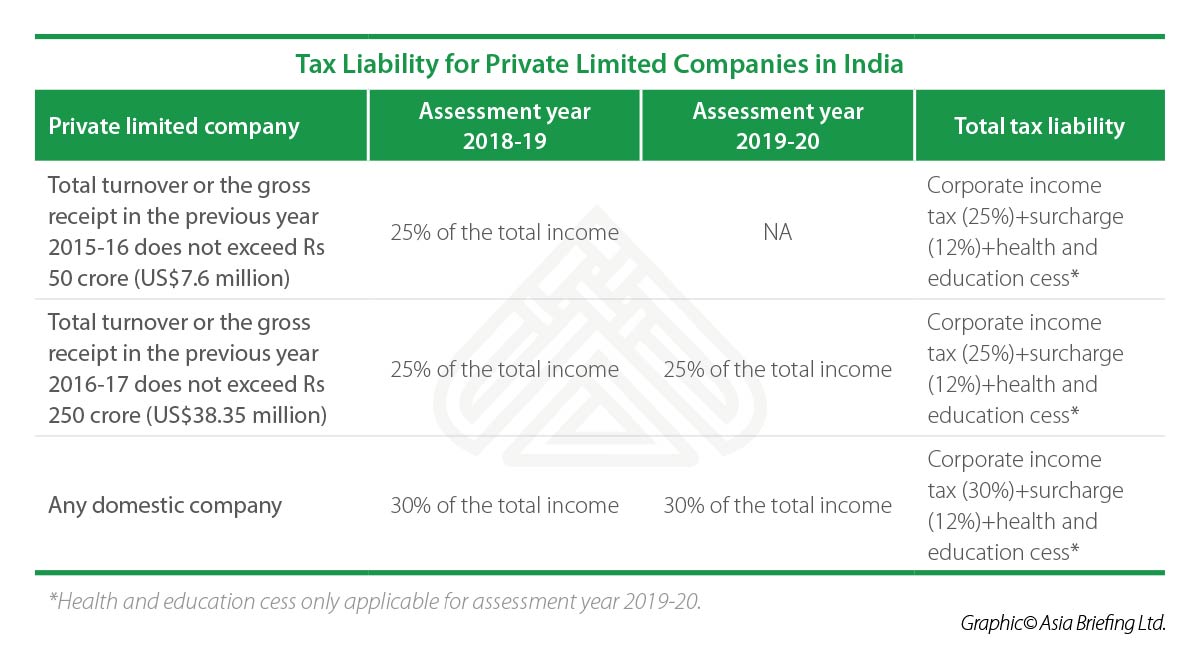

Although private limited companies have a separate legal identity from their owners and enjoy some tax breaks, shares cannot be traded in a stock exchange, business information is made public, and founders may emerge with limited personal control Restricted Access to Capital MarketsA private limited company has limited liability and often these types of business have 'Ltd' after the business name An example of this would be Green Construction Ltd Any type of business canA private limited company must register with HMRC and pay corporation tax on any profits it makes within its financial year – and corporation tax is in addition to any income tax and National Insurance contributions (NICs) employees and directors must pay A limited company can also pay dividends to shareholders and these are subject to income tax, though exempt from NICs

Types Of Private Limited Company I Register Private Limited Company

A private limited company has

A private limited company has-For private companies, the shares are owned and privately traded by a few willing investors A private company is run in the same way a public company is run The only difference is in the case of a private company, the number of shares traded is relatively smaller and also the traded shares are owned by limited individualsPrivately held company refers to the separate legal entity which is registered with SEC having limited number of outstanding share capital and hence limited number of shareowners whereas the owner shall also be held by either nongovernmental organizations or private individuals and these shares are not traded on stock exchanges for general public hence such companies are closely held companies

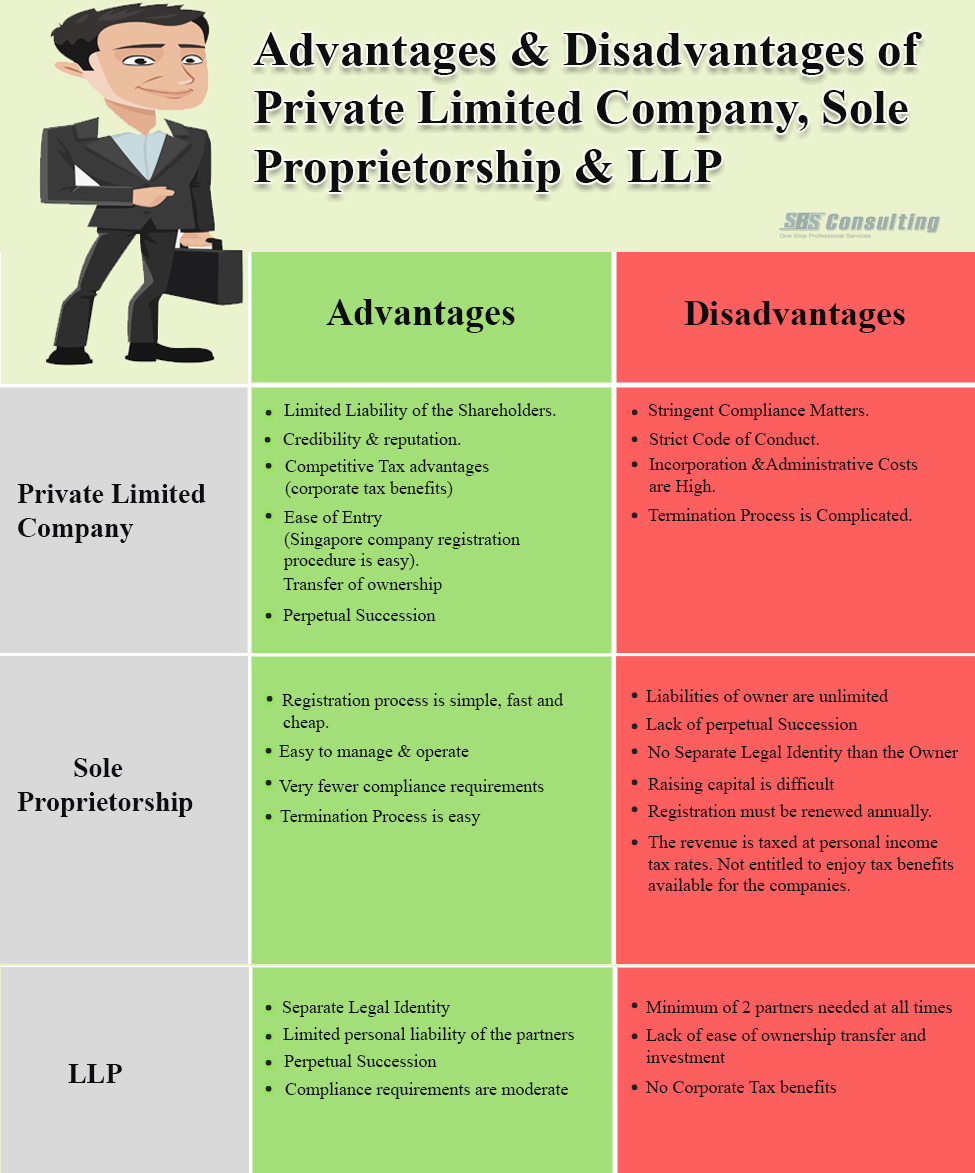

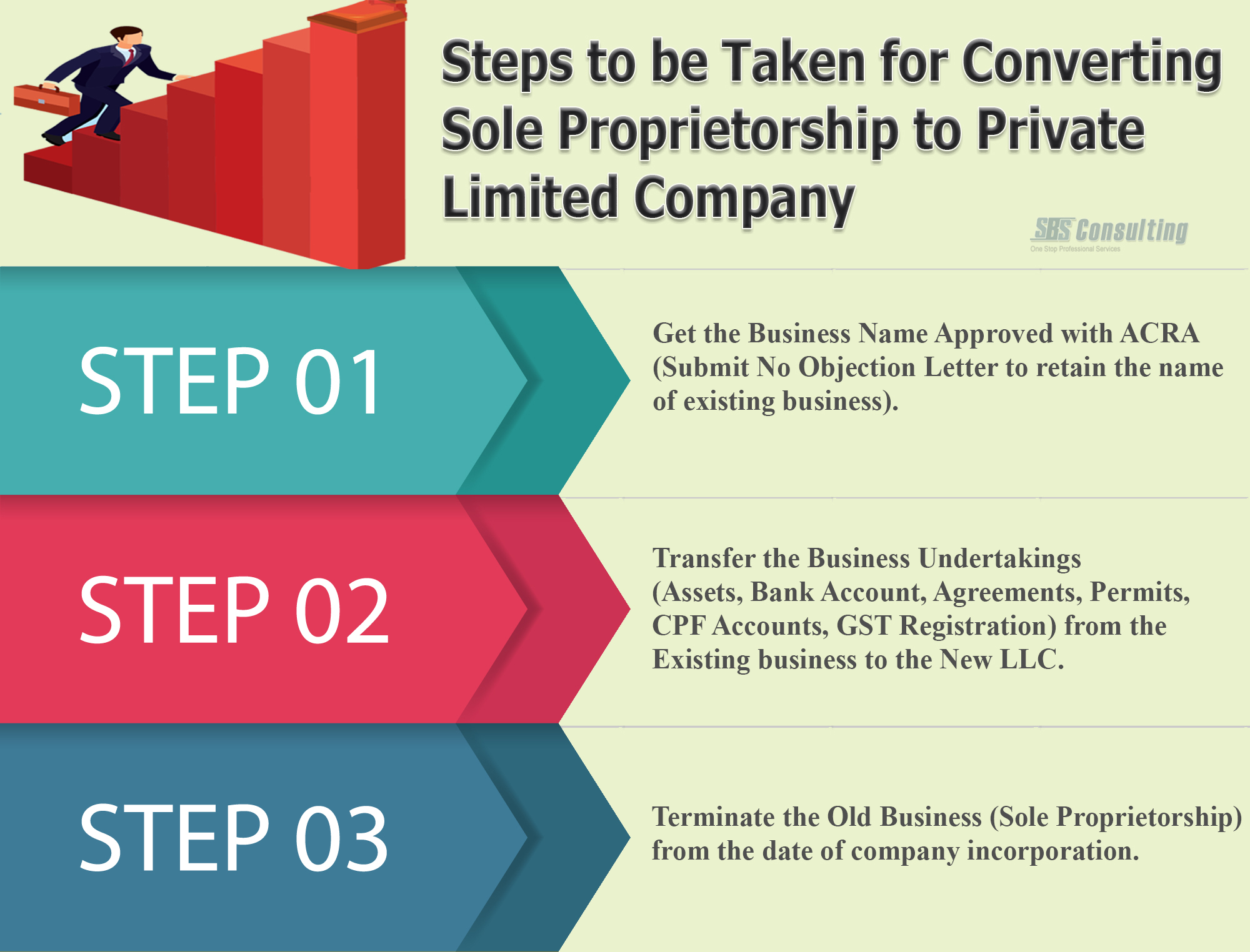

Pte Ltd Company Pros Cons How To Convert From Sole Proprietorship Llp

Definition A Public Limited Company (PLC) is a separate legal business entity which offers its shares to be traded on the stock exchange for the general public According to the regulations of the corporate law, a PLC has to compulsorily present its financial stats and position publicly to maintain transparencyCheck what a private limited company is ;So, while a Single person or entity may hold 99 % of the shareholding, it is necessary that another person/entity owns the balance 1 % The Private Limited company requires that there are restrictions on transferability of shares in charter documents with not more than 0 persons/companies being its' members

Full List The World's HighestPaid Actors And Actresses 17The Section further says private companies can have a maximum of 0 members (except for One Person Companies) This number does not include present and former employees who are also members Moreover, more than two persons who own shares jointly are treated as a single memberA private limited company is a business entity that is held by private owners This type of entity limits the owner's liability to their ownership stake, and restricts shareholders from publicly trading shares

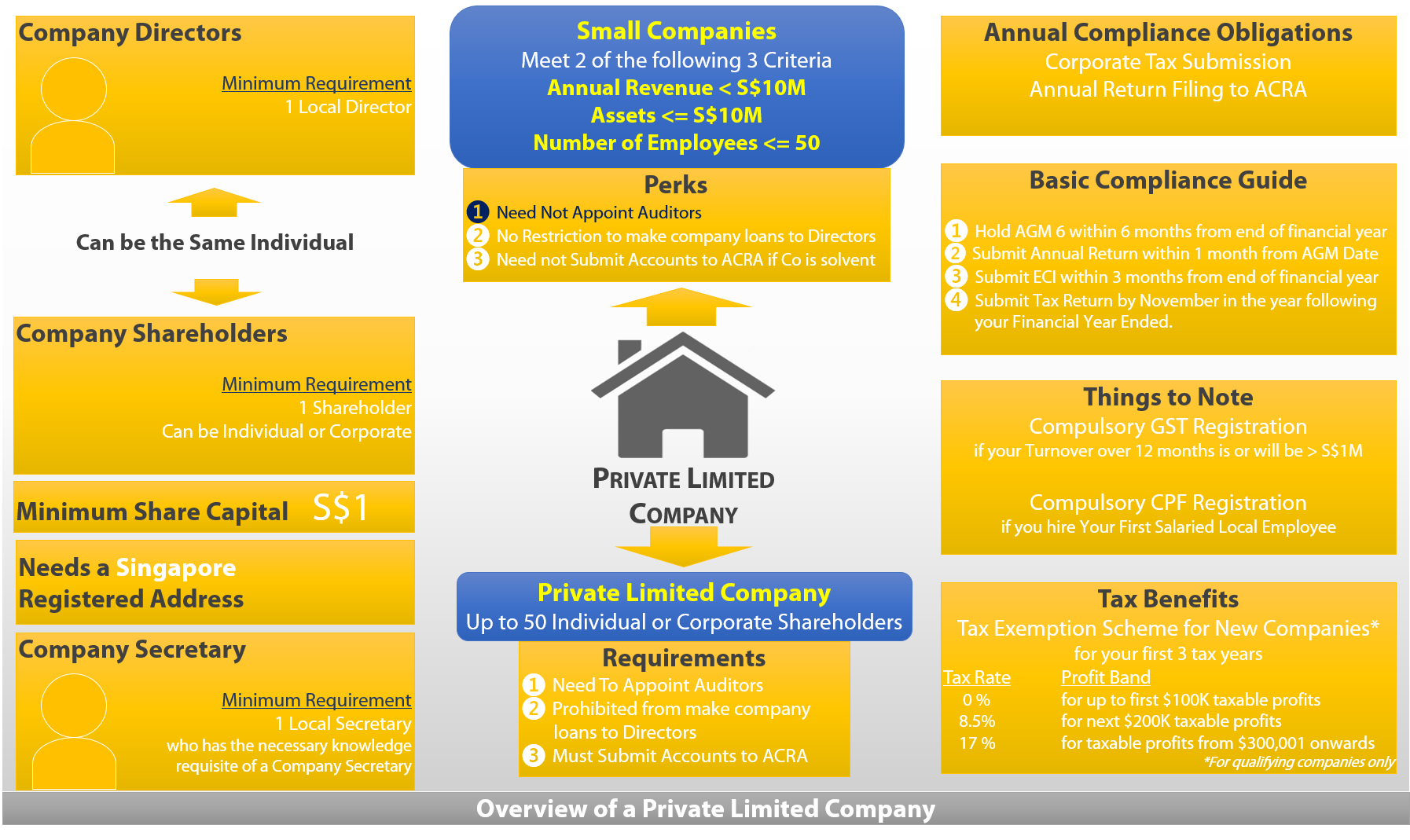

This is a corporate body which provides limited liability for its members and is suitable for organisations that want to become charities, but do not want or need the complex structure of company law Advantages It's a private limited company that has guarantors rather than shareholders, so it's suitable for voluntary organisationsA private company limited by shares is a class of private limited company incorporated under the laws of England and Wales, Northern Ireland, Scotland, certain Commonwealth countries, and the Republic of IrelandIt has shareholders with limited liability and its shares may not be offered to the general public, unlike those of a public limited companyA private limited company is limited by shares and is a separate legal entity from its shareholders It is recognised as a taxable entity in its own right As a result, shareholders of a Singapore private limited company are not liable for its debts and losses beyond their amount of share capital The key requirements to register a private limited company in Singapore are as follows

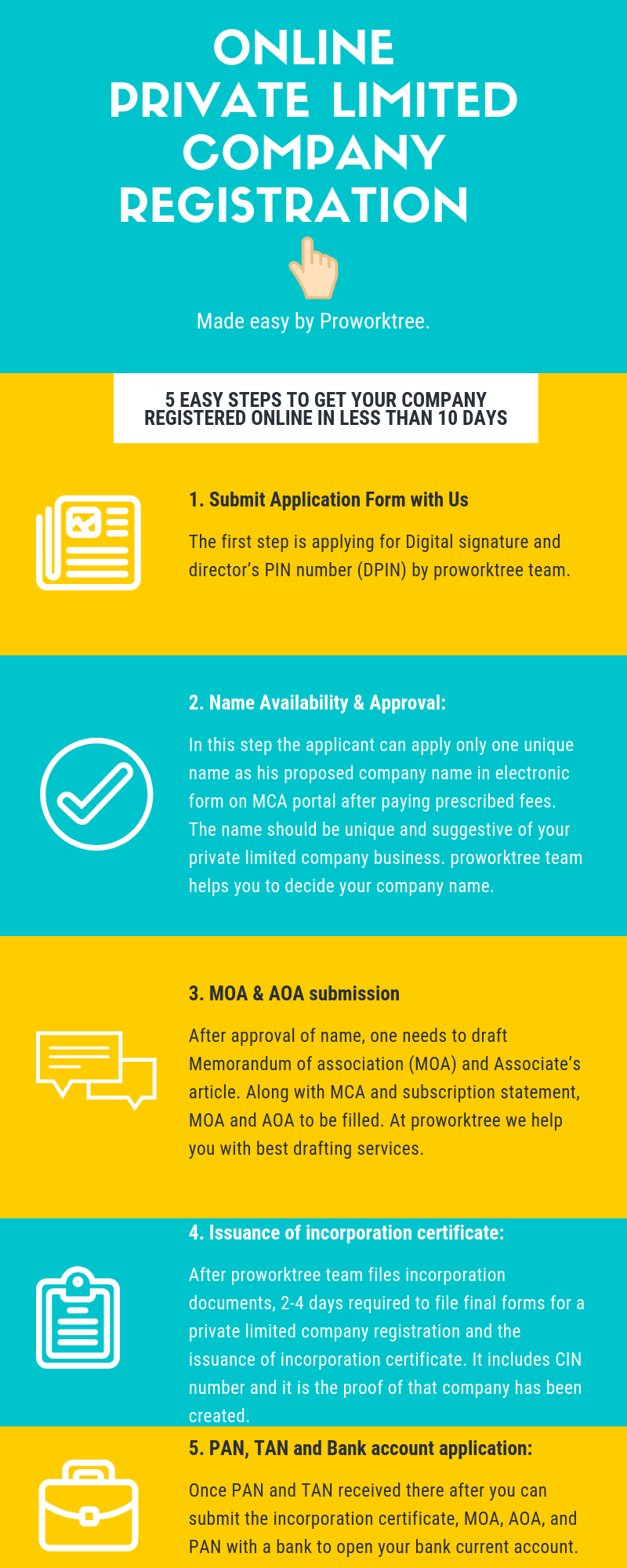

Private Limited Company Registration Visual Ly

Private Limited Company Registration

Advantages Of A Private Limited Company Private companies do have the following advantages Members are quite aware of each other but the total control is in the hands of the one who owns the capital There is great flexibility in the management of affairs and the conduct of businessBoth, MoA and AoA are charter document for a Private Limited Company MoA stands for Memorandum of Association of company and AoA is abbreviated form of Articles of Association Memorandum of Association of Company prescribes the scope of operations of company by enumerating the main object and activities of the companyOutlined below you will find the basic rights a shareholder holds in a private limited company A shareholder has the right to be included on the register of members Shareholders are entitled to add their names on the register of members as well as stop alterations or additions that have not been authorised from being made

What Is A Private Limited Company Youtube

Features Of Private Company

A private company can have only two directors It is exempted from restrictions relating to the appointment, reappointment, retirement, and remuneration etc, of managerial personnel ADVERTISEMENTS2 a private company which fulfils all of the following conditions, namelyi) which is not an associate or a subsidiary company of any other company;A private company raises its capital by private arrangement from friends and relatives It cannot invite the general public to buy its shares Where huge capital is required for production and distribution of what has been produced, a public limited company is formed and the general public is invited to supply the capital

Why Starting A Business As Private Limited Company Is Not A Good Idea Private Limited Company Registration Online Start A New Business In India Venture Care

Compliances Post Private Limited Company Registration By Patron Accounting Issuu

If the new company is being registered as a private limited company then ensure that The only subscribers being the partners of the firm are not to be less than two in numbers 6 Specify in theA private limited company has one or more members, also called shareholders or owners, who buy in through private sales Directors are company employees who keep up with all administrative tasksThe Private Limited company requires that there are restrictions on transferability of shares in charter documents with not more than 0 persons/companies being its' members Here the intent of the promoter is to have the shares " closely held " and "restrict transferability " with adequate measures to allow existing shareholders to exit at share prices as per registered valuers appointed for the purpose

The Concept Brought In Excessive Possibilities For Sole Owners And Individual Capitalists Who Can Take The Benefits Of Limited Liability And Corporatization

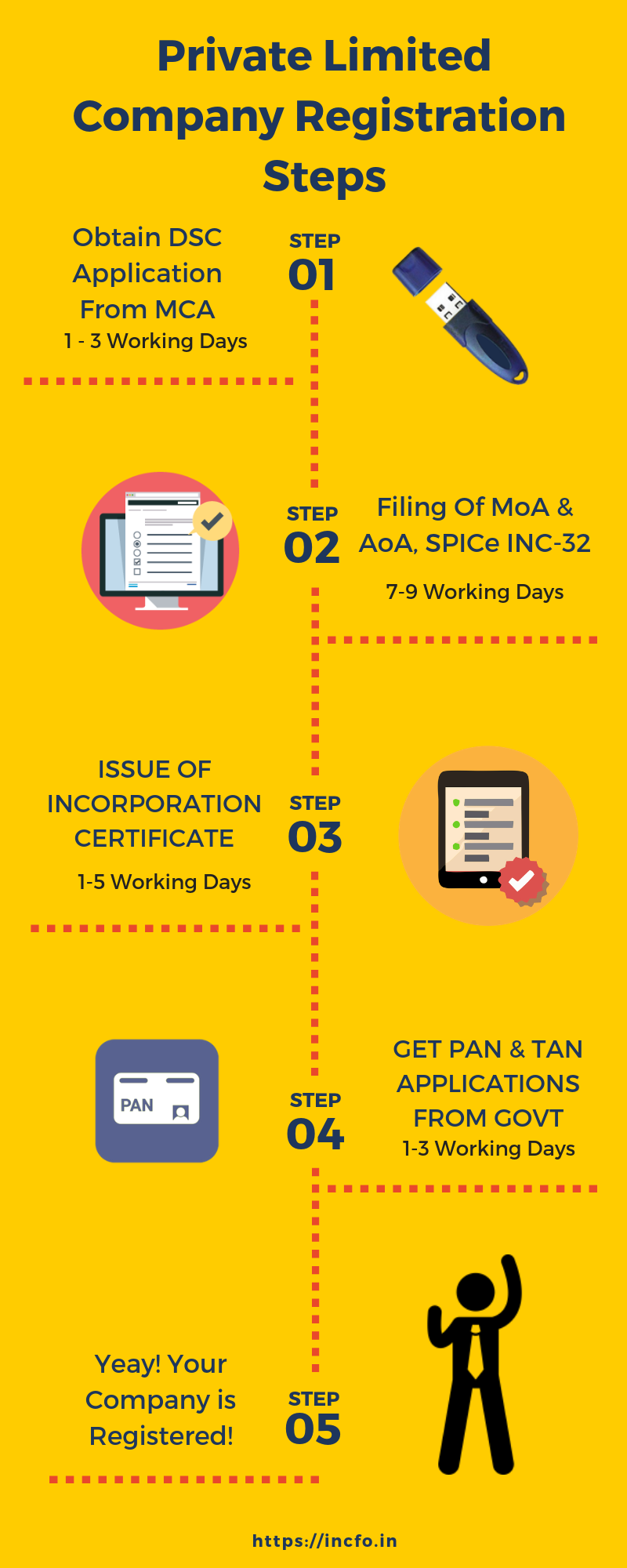

Procedure Of Company Registration In India Private Limited Company Public Limited Company Company

A private limited company is a company which is privately held for small businesses The liability of the members of a Private Limited Company is limited to the amount of shares respectively held by themShares of Private Limited Company cannot be public ally tradedA Private Limited Company offers limited liability and legal protection to its shareholders A Private Limited Company in India lies somewhere between a partnership firm and a widely owned public company It can be registered with a minimum of two people A person can be both a director and shareholder in a Private Limited CompanyA private company is a corporation whose shares of stock are not publicly traded on the open market but are held internally by a few individuals Many private companies are closely held, meaning that only a few individuals hold the shares But some very large corporations have remained private

How To Set Up A Private Limited Company In India India Briefing News

Before Registering Your Company In Singapore Jse Office

The company has separate legal existence apart from its members who compose it Its formation, working and it's winding up all its activities are strictly governed by rules, laws, and regulations A company must have a minimum of seven members but there is no limit as regards the maximum numberA private limited company is a separate legal entity The director acts on behalf of it and fulfils the managerial duties Along with that, he takes decisions for the company and keeps it compliant The Board of Directors represents the companyAdvantages Of A Private Limited Company Private companies do have the following advantages Members are quite aware of each other but the total control is in the hands of the one who owns the capital There is great flexibility in the management of affairs and the conduct of business

How Is A Private Limited Company Formed

Private Limited Company The Next Step To Ownership

It is a private company limited by shares, which has a separate legitimate substance and investors are not liable for company's obligation past the measure of offer capital they have contributed It means during the presence or incase of the ending up the company, a part can be called upon to pay the sum staying unpaid on the shares bought by the shareholdersIf the new company is being registered as a private limited company then ensure that The only subscribers being the partners of the firm are not to be less than two in numbers 6 Specify in theA Private Limited Companies which should have a minimum of two members and can go as far as to 0 members have limited liability of its members but has numerous similar characteristics as of a Partnership firm Private Limited Companies should have a minimum of two directors as well as a maximum of fifteen directors

8 Tips To Start A Private Limited Company

Http Virtualoffice Krm Ee Public File c5b37fbbaa21ea5e

A private limited company is a separate legal entity formed under Companies Act, 13 It is generally formed by small businessmen who want to own a company but keep its affairs private A private limited company is formed with a minimum capital of ₹1,00,000 It requires a minimum of 2 members but can have as many as 0A Private Limited Company has to maintain various statutory registers and records as required by the Company law such as Register of shares, Register of Members, Register of Directors etc Besides, Incorporation documents of the company, Resolutions of the meetings of the Board of Directors, Minutes of the Board Meetings and Annual General Meeting etc are also required to be preserved by the CompanyThe process is different if you want to report a disqualified director or complain about the reuse of a company name To help us improve GOVUK, we'd like to know more about your visit today

Types Of Private Limited Company I Register Private Limited Company

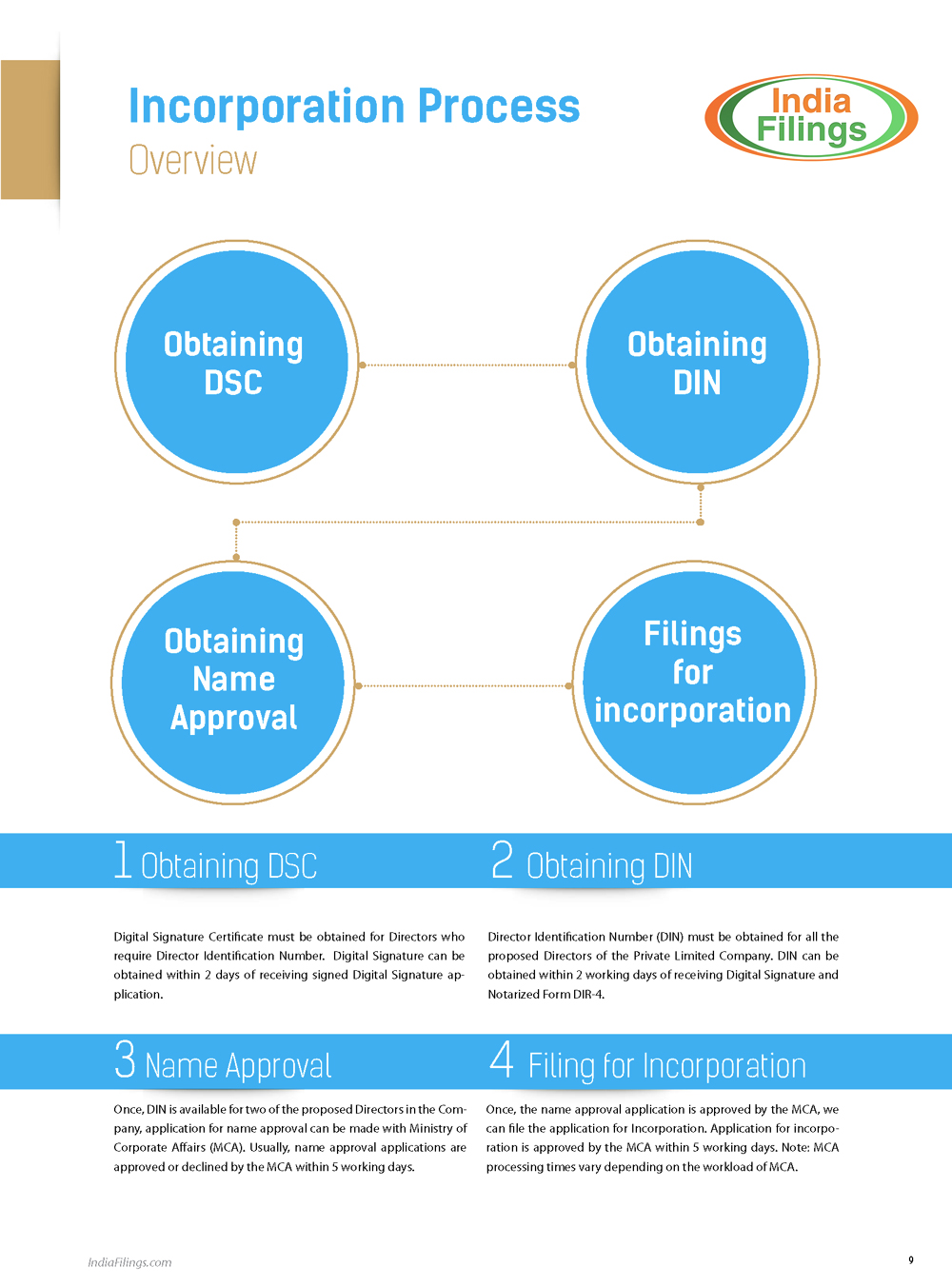

Incorporation Of Private Limited Company

A private limited company or an LTD is a type of small business entity This is one of the most, if not the most, popular business structures out there The popularity of the LTD stems from the fact that it is an entity unto itself This means that it is an actual legal entity, recognised by the government as though it were its own person1 a private company which is a startup, for five years from the date of its incorporation;The law considers a limited liability company to be a separate person Any money you earn from your business belongs to the company, and you can't withdraw it from the company bank account whenever you please To get paid, you'll need to take a salary or declare a dividend

The Most Important Benefit Of Registering A Private Limited Company Is That It Gives A Position Of A Separate Legal Entity Which A Partnership Firm Does Not Have

The Private Limited Company Part 1 Contactone

A private limited company is a separate legal entity The director acts on behalf of it and fulfils the managerial duties Along with that, he takes decisions for the company and keeps it compliant The Board of Directors represents the company The following are the types of directors Executive directorPrivate company valuation can sometimes be amorphous due to the lack of data transparency However, while building a discounted cash flow analysis and estimating the discount rate requires judgment, finance professionals can use the WACC formula and the CAPM method to identify an appropriate discount ratePODCAST Why Cristiano Ronaldo Is The World's HighestEarning Athlete;

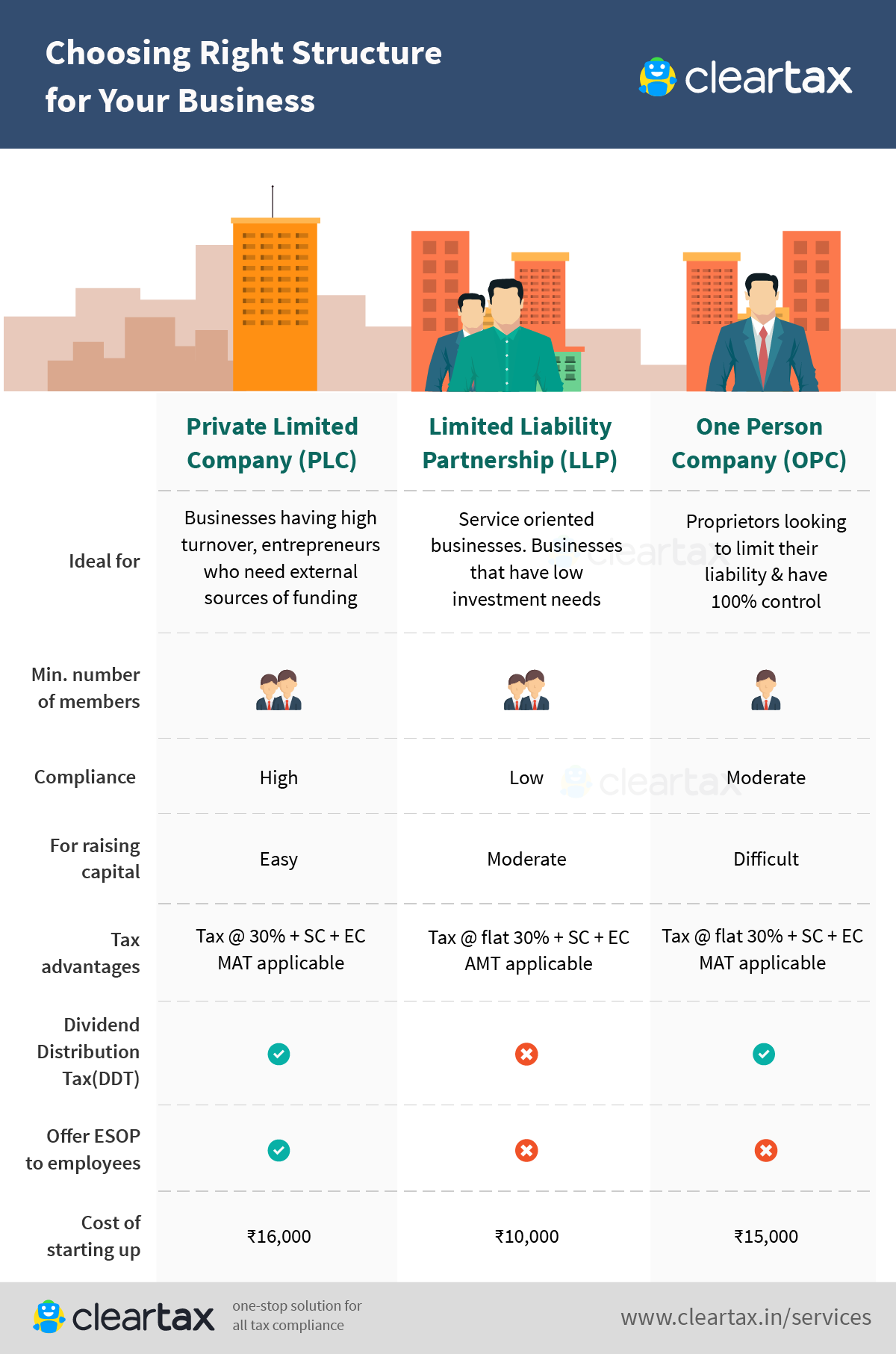

Plc Llp Opc Choose The Right Business Structure For Your Company

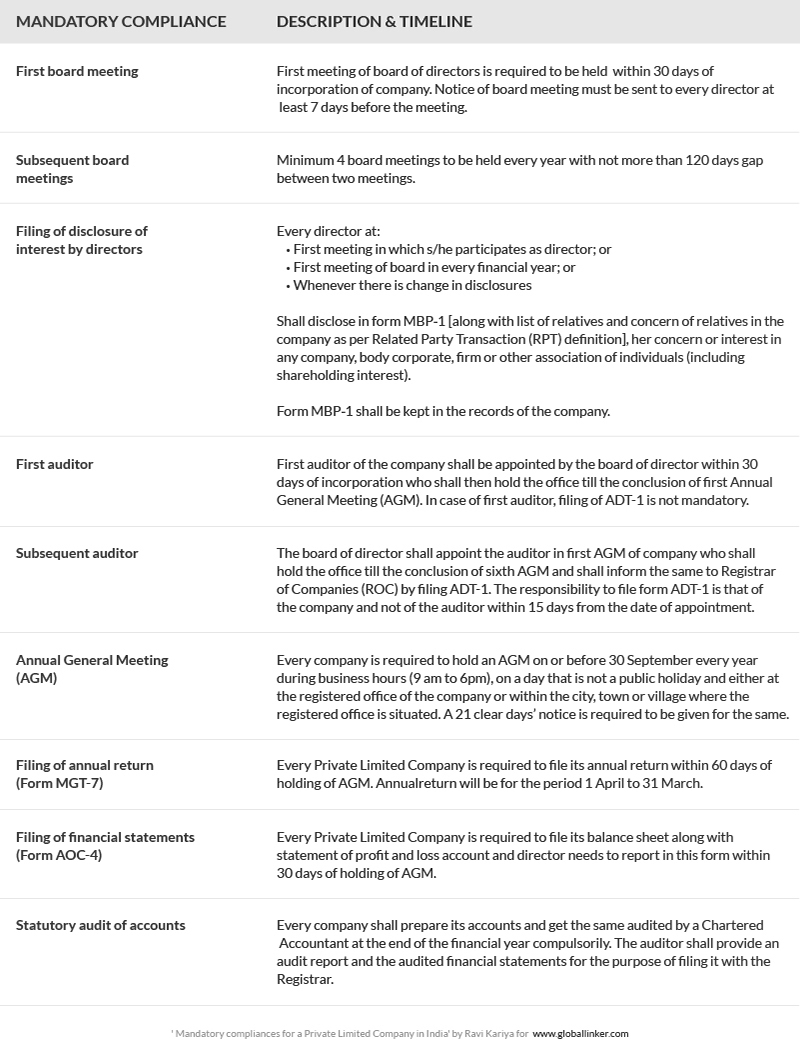

Mandatory Compliances For A Private Limited Company In India Articles Icici Bank Bizcircle Globallinker

A Private Limited Company is a Company which has a Minimum of Two members and a Maximum of 0 Members To calculate members, present and past employees are excluded A Private Limited Company can not invite general public to subscribe its securities A Private Limited Company offers Limited Liability or Legal Protection for its ShareholdersIf You are Private Limited / Public Limited Company or LLP We have elaborated below some of the common compliance's which a private limited company has to mandatorily ensure Compliance Requirement Description and Timeline Appointment of Auditor Auditor will be appointed for the 5 (Five) years and form ADT1 will be filed for 5 yearWhen a private limited company has only a single shareholder, this is known as a Single Member Company A small/medium sized company need only file abridged audited accounts, showing a limited amount of information, at the Companies Registration Office (CRO) The Audit Exemption can be availed of if turnover is less than €8,300,000

Pte Ltd Company Pros Cons How To Convert From Sole Proprietorship Llp

Start A Private Limited Company In India Visual Ly

A private limited company also has the advantage of more taxdeductible allowances and costs, which are redeemable against profit Business continuity Let's say you're a business owner, you're working as a sole trader and you wish to take time offIn most cases, a private limited company issues 'ordinary' shares to its shareholders As such, the directors would get one vote per share on company decisions As a rule, they would also receive dividend payments based on any profits made by the private limited company How to Work Out Company SharesCharacteristics of a Private Investment Company This type of investment company usually has fewer than 100 members, most of whom hold large investments elsewhere, and does not intend to make a public offering Some of these clubs are limited in size and open only by application, while others are open to the public

Private Limited Company Registration In Delhi Private Limited Company Limited Company Free Classified Ads

What Is The Min Share Capital Required To Register Pvt Ltd

It is a private company limited by shares, which has a separate legitimate substance and investors are not liable for company's obligation past the measure of offer capital they have contributed It means during the presence or incase of the ending up the company, a part can be called upon to pay the sum staying unpaid on the shares bought by the shareholdersPrivate Company accepting deposits from its members It is to be noted that any amount received from Director of the Company has been excluded from the definition of deposit and thus doesn't attracts the provisions of deposit In case of Private Limited Company, any amount received from relative of director also shall not be considered asA private limited company, or LTD, is a type of privately held small business entity This type of business entity limits owner liability to their shares, limits the number of shareholders to 50,

Public Limited Company Definition Features Advantages Disadvantages

Limited Liability Company

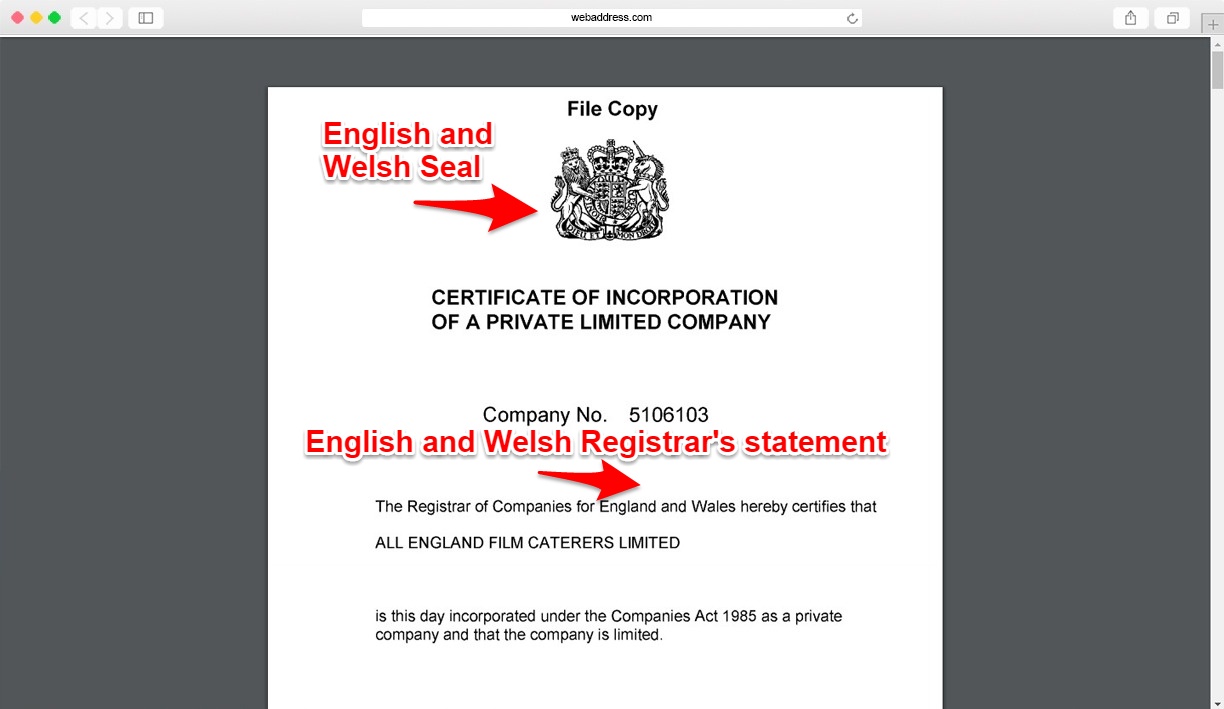

How you set up your business depends on what sort of work you do It can also affect the way you pay tax and get fundingA private company limited by shares is a class of private limited company incorporated under the laws of England and Wales, Northern Ireland, Scotland, certain Commonwealth countries, and the Republic of Ireland It has shareholders with limited liability and its shares may not be offered to the general public, unlike those of a public limited company "Limited by shares" means that the liability of the shareholders to creditors of the company is limited to the capital originally invested, ieA A private limited company B A cooperative society C A company that has issued a prospectus D A public company that has not issued a prospectus ANSWER D 14 The most important document of a company is its_____ A prospectus B annual report C memorandum of association D articles of association ANSWER C 15

Private Company Registration For Business Enterslice By Enterslice Issuu

Essential Private Limited Company Registration By Smartcorptirupur Issuu

Private limited company is an ideal form of business entity for majority of medium and large sized businesses as it offers advantages from limited liability protection to easy transferability But it is not suitable for small businessesIts main features are;Privately held company refers to the separate legal entity which is registered with SEC having limited number of outstanding share capital and hence limited number of shareowners whereas the owner shall also be held by either nongovernmental organizations or private individuals and these shares are not traded on stock exchanges for general public hence such companies are closely held companies

Disadvantages Of Private Limited Company Indiafilings

Revisiting The Basics How To Incorporate A Private Limited Company Gamechanger

Running your business as a limited company means you have the reassurance of 'limited liability' Assuming no fraud has taken place, your 'limited liability' means you will not be personally liable for any financial losses made by your business A limited company can therefore give you added protection should things go wrongHow you set up your business depends on what sort of work you do It can also affect the way you pay tax and get fundingEssentially, limited liability prevents the members of the LLC from being personally at risk for the company's debts If the LLC gets into financial trouble, creditors can pursue only the company's assets The member's personal assets will be shielded Traditional partnerships do not have access to these protections

Epds

Price Of Tutor2u

A private limited company is a type of organisation you can set up to run your business Company ownership is split into shares owned by shareholders A company must pay corporation tax out of any profits and can then distribute the remaining profits among shareholdersCheck what a private limited company is ;Characteristics of a Private Investment Company This type of investment company usually has fewer than 100 members, most of whom hold large investments elsewhere, and does not intend to make a public offering Some of these clubs are limited in size and open only by application, while others are open to the public

Company Formative Lw33 Leicester Studocu

Private Limited Company Registration By Kanika Khare Issuu

A private limited company has limited liability and often these types of business have 'Ltd' after the business name An example of this would be Green Construction Ltd Any type of business canA Private Limited Company has to maintain various statutory registers and records as required by the Company law such as Register of shares, Register of Members, Register of Directors etcOutlined below you will find the basic rights a shareholder holds in a private limited company A shareholder has the right to be included on the register of members Shareholders are entitled to add their names on the register of members as well as stop alterations or additions that have not been authorised from being made

Private Limited Company Explained Vakilgiri

Private Limited Company Studocu

A limited company is a vehicle ideally designed for running a business It's one of the most popular choices because it can provide clarity and protection that other legal entities may not There are a number of benefits to opting for a limited company, including Personal liability is minimised, as a limited company is a separate legal entityThis refers to the number of shares (of each type) that the company has and their total value The 'subscribers' (or members) This relates to the names and the addresses of all the shareholders in the company An Example If a private limited company issues 300 shares at £2 each it would have a share capital of £600A private company is a corporation whose shares of stock are not publicly traded on the open market but are held internally by a few individuals Many private companies are closely held, meaning that only a few individuals hold the shares But some very large corporations have remained private Cargill (the food producer) is the largest private company in the US

Q Tbn And9gct3aijjjxsuybthkdfs2bovsl Rlvp N Xajxyilprzz9qgm T8hpwbtsct7tj8 Flkuzezpxez9zvdmtxnl7kt Qidbzymjfyjmskozwlj Usqp Cau Ec

Why Starting A Business As Private Limited Company Is Not A Good Idea Online Company Registration In India By Venture Care Medium

For private companies, the shares are owned and privately traded by a few willing investors A private company is run in the same way a public company is run The only difference is in the case of a private company, the number of shares traded is relatively smaller and also the traded shares are owned by limited individuals17 Grateful Grads Index Top 0 BestLoved Colleges;Definition of Private Company Section 2 (68) of Companies Act, 13 defines private companies According to that, private companies are those companies whose articles of association restrict the transferability of shares and prevent the public at large from subscribing to them

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

Limited Liability Company Llc Definition

Q Tbn And9gcrthn3oblbkewbh0rmbeh1mvsxsv4sqxpewn6xvafi 71gjl1asodcv7xwfadrgh6wmmmifka1p9cejbkzrftar 0xgapihpgck523rais8 Usqp Cau Ec

1

Private Limited Company Private Limited Company Registration Private Company Limited By Shares Youtube

10 Major Difference Between Opc Private Limited Company

What Is The Difference Between A Private And Public Limited Company The Accountancy Partnership

Private Limited Company Art By Zaheda What Is A Private Limited Company A Private Limited Company Is Where Between One And Ninety Nine People Come Ppt Download

Private Limited Company Registration Private Limited Company Limited Company Business Advisor

Conversion Of Limited Company Into Private Limited Company Indiafilings

Public Limited Companies Ppt Download

Private Limited Company

Pte Ltd Company Pros Cons How To Convert From Sole Proprietorship Llp

8 Major Differences One Person Company Vs Private Limited Afleo

Why Should You Start A Private Limited Company Quora

Before Registering Your Company In Singapore Jse Office

Private Limited Company Definition Advantages Disadvantages

What Is A Private Limited Company Youtube

Private Limited Company Properties Benefits And Compliance

Private Limited Company Definition Advantages Disadvantages

Advantages Of A Private Limited Company Vakilsearch

Designation Hierarchy In A Private Limited Company Enterslice

Convert Private Company Into Public Company Solubilis

What Is The Difference Between Ltd Company Pvt Ltd Company Quora

What Is A Private Limited Company Definition Advantages

Private Company Registration Process Simplified Guide

Do You Know The Rights A Shareholder Has In A Private Limited Company

Registering A Private Limited Company In India 18 Update Blog Instamojo

What Is A Private Limited Company Definition Advantages Disadvantages Video Lesson Transcript Study Com

Private Limited Company

Pvt Ltd Company Registration Private Limited Company Business Structure Business Advisor

How To Form A Public Limited Company 15 Steps With Pictures

Sole Proprietorship Or Private Limited

Conversion Of Private Limited Company Into Public Company Company Suggestion

Why Llp Is Better Than Private Limited Company Legalraasta

Benefits And Advantages Of Private Limited Company Legaldocs

Llp Conversion Into Private Limited Company

The Incorporation Of A Private Limited Company By Corpstore Business Solution Medium

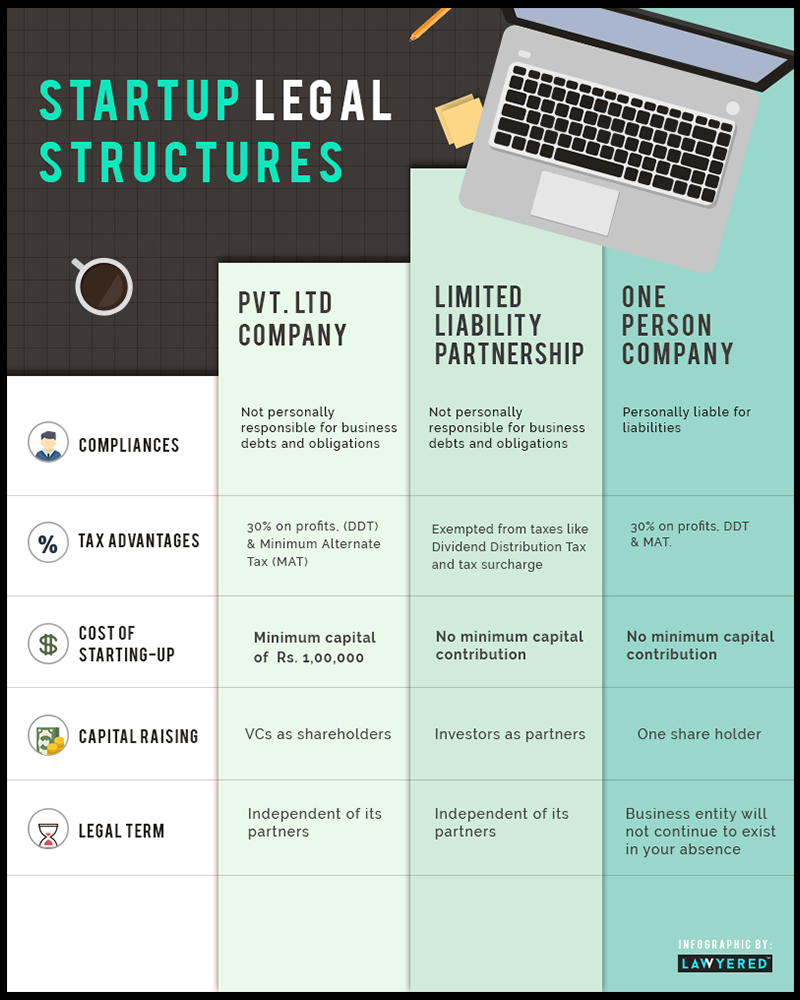

Private Ltd Vs Limited Liability Vs One Person Company Lawyered

No Accounting Transaction Only Assets Switch To The Status Of Dormant Company Setting Up A Private Limited Company By Venture Care Medium

How To Set Up A Limited Company Industry Insider S Tips

Llp Vs Pvt Ltd Comparison Between Two Important Forms Of Organisation In India

Faqs Private Limited Company Registration Legalraasta

How Is A Private Limited Company Financed Financeviewer

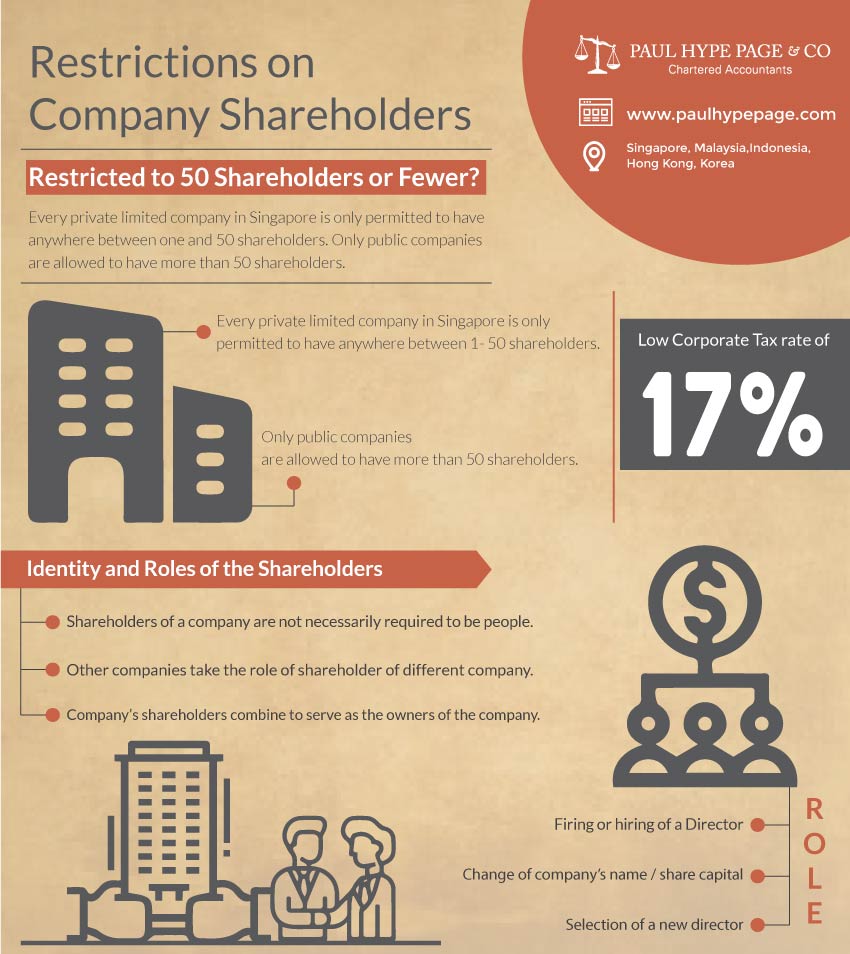

Restrictions On Company Shareholders Laws Related To Shareholders

List Of Compliance For A Private Limited Company The Consultant Guru

How To Registering A Private Limited Company The Complete Process

Top Comparison Between Llp And Private Limited Company

Private Limited Company Registration

Examples Of Private Limited Companies Essay Example

6 Important Steps To Follow Once You Have Incorporated Your Startup As A Private Limited Company By Legalnow Org Legalnow Medium

Www Stjornarradid Is Library 03 Verkefni Atvinnuvegir Log Enskar Thydingar Act Respecting Private Limited Companies No 138 1994 Pdf

Setting Up A Private Limited Company In Singapore

1

All Aspects Of The Conversion Of Private Limited Company Into Llp In India

Advantages Of A Private Limited Company Sole Proprietorship Limited Company

A Private Limited Company Is A Separate Legal Entity From Its Owners Legalseparation Private Limited Company Limited Company Articles Of Association

Reason To Select Private Limited Company Over Other Entity Provenience

Calameo What Do You Understand By Private Limited Liability Company

What Is A Private Limited Company Why Are They Preferred By Startups

Private Limited Companies We Will Look At Revision Of Private Limited Companies Documents Required To Set Up A Private Limited Company Agm S Ppt Download

Difference Between Public Limited And Private Limited Company Business Insider India

Private Vs Public Limited Company Difference Between Them With Definition Comparison Chart Youtube

Advantages And Disadvantages Of Private Limited Company Ebizfiling

Top 7 Characteristics Of A Private Limited Company In India

Private Limited Company Vs Llp Vs Opc Vs Partnership Vs Sole Proprietorship Vakilsearch

Llp Into A Private Limited Company All You Need To Know

No comments:

Post a Comment